The Institute of Chartered Accountants of India (ICAI) has released admit card for CA December 2021examination.

The Students can download admit card from the official website “https://icaiexam.icai.org/”

Note: No physical admit cards will be sent to any candidate. Candidates are required to download and print their admit cards from the website.

Admit card printed from the website contains your photograph and specimen signature, besides other necessary details and is a valid admit card for gaining admission to the examination.

Steps to Download Admit Card

In order to download/print the admit cards, the candidates will have to login at icaiexam.icai.org as under:

1. Visit https://icaiexam.icai.org/

2. Login using your Login ID (Registration Number) and password.

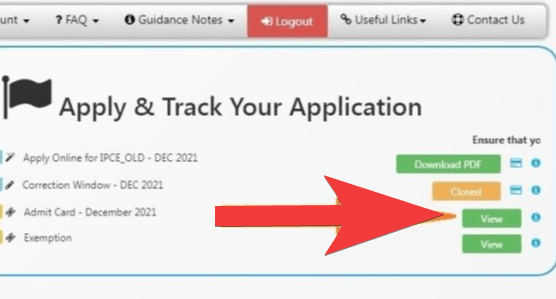

3. Click on the View button in front of Admit Card – December 2021 and download it.

For any further clarifications, write to/contact:

Foundation candidates :

foundation_examhelpline@icai.in

0120 3894811, 812

Final candidates: :

final_examhelpline@icai.in

0120 3894807, 808, 827

Intermediate candidates :

intermediate_examhelpline@icai.in

0120 3054806, 819

Help Line Telephone numbers:

0120 3054 851, 852, 853, 854 and 835,

0120 4953 751,752, 753 and 754

Join EduTaxTuber Network for the Latest updates on Income Tax, GST, Company Law, Stock Market and other related subjects.

Also, read other articles @ EduTaxTuber

-

GSTR 3B Revision: Advisory on Reset and Re-filing of GSTR-3B of some taxpayers

-

T+0 Settlement: Revolutionizing the Market for Investors and Traders, Check Details for more

-

Bharat Ratna 2024: The Country’s Highest Civilian Honour conferred on 5 Eminent Personalities

-

Vacancy in NVIDIA for Graduate, Postgraduate: Apply Now

-

TDS Rates for Financial Year 2024-25 and Assessment Year 2025-26 effective from 1 April 2024

-

Vacancy in Deloitte for MBA: Apply Now in Big 4

-

Before planning a trip to Ladakh, decode the political turmoil that erupted ahead of the Lok Sabha election 2024.

-

ICAI Announces Mock Test Series – II for CA Final and Intermediate May 2024 Examination

-

ICAI Revised Schedule for May 2024 Exam: Live Update CA Inter and CA Final Exam 2024

-

MID Function Excel Practice Online